By Li Jiabao ( China Daily )

China may soon be named the world's largest trader in goods

Even as China faced huge economic challenges last year, it may have knocked the US off itsperch as the world's largest goods trading nation.

Whether that happened will become clear when the US publishes figures for December soon, butearlier figures pointed strongly in that direction.

Until recently China has been the world's largest exporter of goods and the second largestimporter of goods.

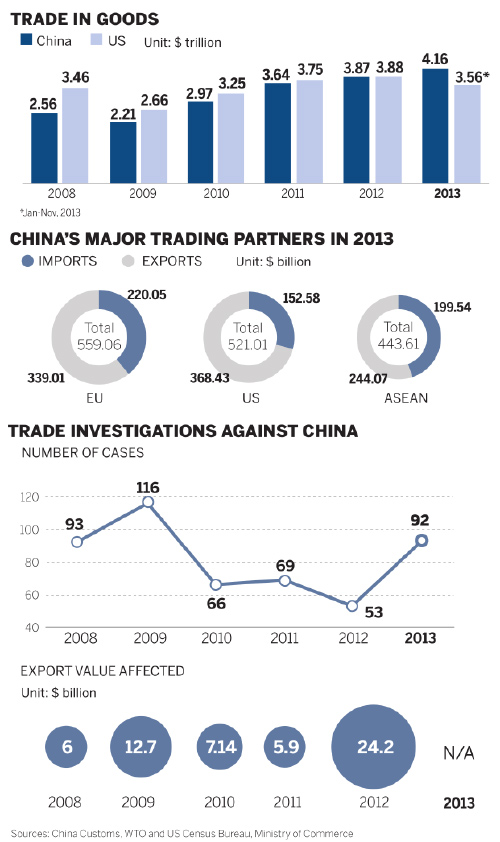

Last year, combined exports and imports rose 7.6percent to $4.16 trillion, the General Administrationof Customs says. Exports were worth $2.21 trillion, 7.9 percent higher than the year before. Importswere worth $1.95 trillion, 7.3 percent higher than theprevious year, giving China a trade surplus of$259.7 billion.

The government has been on a mission to improvethe quality of the country's overseas trade and theway it is conducted. Zheng Yuesheng, a spokesmanfor the customs administration, says that aneconomic warming-up in China's big export marketshas contributed to last year's strong figures.

In the first 10 months of the year the combined value of China's exports and imports exceededthat of the US by $192 billion. The pace of growth outstripped that of the US by 7 percentagepoints, Zheng says.

"The value of US exports and imports rose less than 1 percent in the first 11 months. On thosefigures, it's all but certain that China overtook the US to become the world's largest goodstrader."

The value of US exports and imports in the 11 months to November was $3.59 trillion, about$570 billion less than the corresponding figure for China. The average monthly value of US tradein the 11 months was $326 billion.

The value of China's exports and imports exceeding $4 trillion last year was a milestone, Zhengsays, $1 trillion having been exceeded in 2004, $2 trillion exceeded in 2007 and $3 trillion in2011.

However, overall growth in trade last year failed to reach the government's target of 8 percent, theMinistry of Commerce says. In 2012, China's trade grew 6.2 percent; the government's targethad been 10 percent.

Zhang Yiping, a researcher with China Merchants Securities Co Ltd, says the failure to meet the8 percent target last year was "mainly owing to the unsatisfactory performance of imports".

But on the whole, "exports were not bad", Zhang says. "In emerging economies there wasstronger demand for Chinese exports, while in the US and the European Union demandweakened."

Shen Danyang, a spokesman for the Ministry of Commerce, said at a news conference on Jan16: "Basically China's foreign trade met last year's target, and the results were achieved with alot of hard work. It was an outstanding success internationally given sluggish world demand andthe uncertain recovery."

The country's export juggernaut is made up of numerous small- and medium-sized enterprisessuch as Ningbo Haixin Hardware Co Ltd in Zhejiang province.

Meng Yu, the company’s sales manager, says the value of its exports managed to rise last year,despite its exports to Japan falling and despite rising labor costs, increasing competition andgreater difficulty in borrowing from banks.

"We tightened internal controls to cut costs and improve productivity," Meng says. "We alsodropped low-end products or markets to step up industrial upgrading and improve production.We also brought in more automation to cut the use of labor."

The company, a private business set up in 1995 and which has 280 employees, sells fastenerssuch as bolts and nuts in the United States, Northern Europe and Southeast Asia.

"China's exports are still strongly competitive globally," Meng says. "Well-established factoriesgive the country outstanding manufacturing ability. We are rich in resources and the cost of laboris still lower than in many other places.

"Chinese exporters have made important productivity gains in recent years, but dealing in low-end products is becoming harder."

In recent years doubts have grown about China's export competitiveness because costs,especially for labor, have risen rapidly. Some foreign invested exporters have moved theirChinese plants to Southeast Asian countries where labor is a lot cheaper.

"For private businesses, conditions are not so good for shifting domestic plants to SoutheastAsian countries," Meng says. "Although the cost of labor is much lower, there is a dearth ofresources, and they rely on imports. In some countries, the political and economic environment ispoor, not to mention the big differences in culture and language. There can also be oppositionfrom local competitors or industrial associations."

Shen, the commerce ministry spokesman, said that China's trade growth not only boosts thecountry's economic growth and employment, but also creates huge employment and investmentopportunities for its trading partners. He quotes a report from the World Trade Organization assaying that China is one of the top three import sources for 107 economies of the WTO's 159members and one of the top three export markets for 42 members.

It is important to consider the upgrading and structural improvement in China's goods trade sincethe 2008 global financial crisis, Shen says.

"China's trade structure has made remarkable progress on many fronts over the past five years."

Emerging markets accounted for 61.2 percent of China's total exports last year, compared with53.8 percent in 2008, the Ministry of Commerce says. The mainland's top five trading partnerswere the European Union, the US, the Association of Southeast Asian Nations, Hong Kong andJapan. But combined trade with the EU, the US and Japan accounted for 33.5 percent of China'stotal trade last year, compared with 35.2 percent from the previous year.

At home, the regional structure of exports was also given priority, with central and westernregions accounting for 15.5 percent of China's exports last year, compared with 10.3 percent fiveyears ago. The share of exports by private businesses, which reflects the vitality of China'sexports, was 41.5 percent last year, compared with 26.8 percent five years ago.

In addition, the structure of Chinese exports has changed, high-tech accounting for 29.9 percentlast year, compared with 29 percent in 2008. Last year, high-tech exports were worth $660.34billion, an increase of 9.8 percent year-on-year. Exports of mechanical and electrical productswere worth $1.27 trillion, an increase of 7.3 percent year-on-year, that represented about 57.3percent of the country's overall exports, Shen said.

The share of general trade, as opposed to theprocessing trade — in which parts or raw materialsare imported then re-exported as finished productsonce Chinese businesses process or assemblethem — rose to 52.8 percent of all trade last year,compared with 48.2 percent in 2008, he says. Theprocessing trade accounted for 32.6 percent ofoverall trade last year, down from 41.1 percent in2008.

"Although China is now a leading goods trader,there is still a long way to go for it to turn from alarge goods trader into a strong goods trader,"Shen said.

China's export business remains on the medium- and low-end of global industrial chains and haslimited technology and value added. Challenges also include rising costs, appreciation of therenminbi and orders shifting to emerging economies, Shen said.

However, the ministry is cautiously optimistic about the country's trade prospects, he said. "It'shard to say exactly what growth will be this year, but it is unlikely to be higher than last year."

In trade figures in the first quarter of this year there are likely to be fluctuations because of risingcosts, a shortage of capital, fierce competition and foreign trade figures in the correspondingperiod last year that are widely believed to have been overstated as the result of speculativecapital inflow disguised as trade payments.

"The global economy is recovering, but the momentum is not solid," Shen said. "Costs keeprising at home, challenging small and medium-sized enterprises in particular. Competition isstiffening globally. Orders are drying up as developed economies encourage their overseasbusinesses to repatriate and Southeast Asian countries win more orders because of their lowercosts compared with China."

Zheng, the customs administration spokesman, is also keenly aware of the challenges China'sforeign trade faces this year. "Foreign direct investment in Chinese manufacturing fell last year,suggesting weakened momentum in the country's exports in the near future. Processing tradeimports rose 3.3 percent last year compared with the previous year, indicating that prospects forprocessing trade imports in the near term do not look bright."